The last two years represented a breakout for exits in fintech. We saw the category dominate the IPO market and M&A activity rebounded, reaching record high valuations. Despite the perception in some quarters that fintech was out of favor, exit values have only increased since our last Exits in Fintech report two years ago.

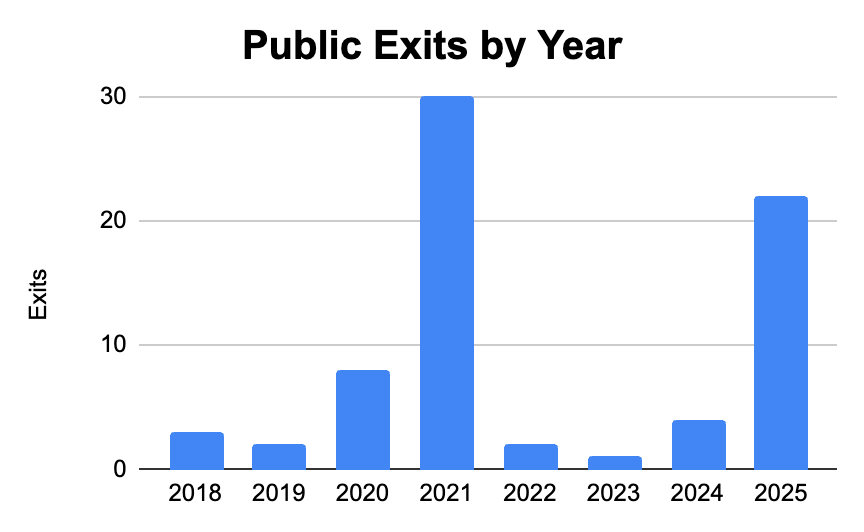

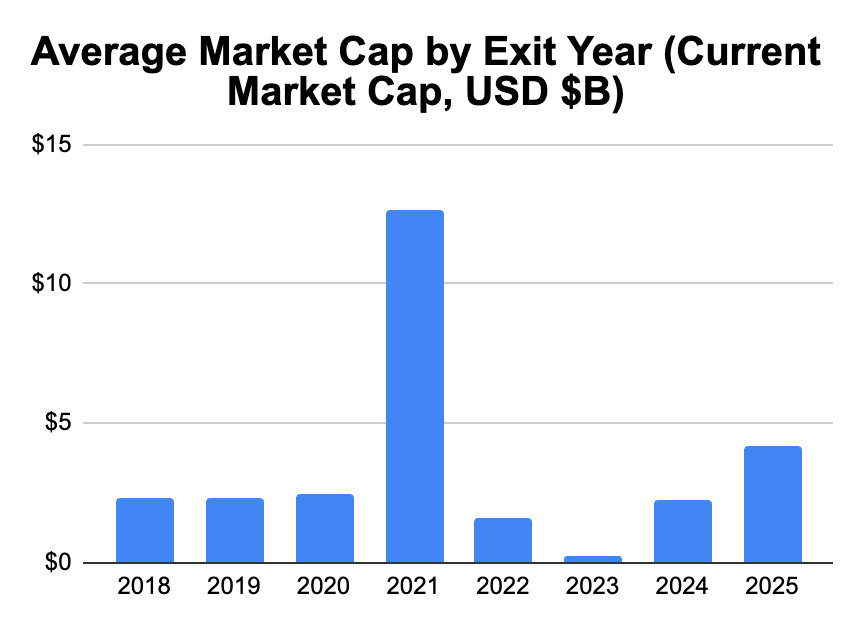

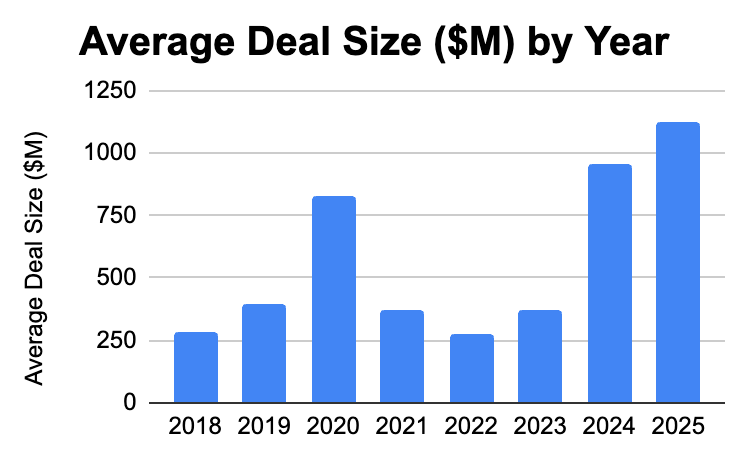

In 2025, fintech IPOs outnumbered M&A, with 22 IPOs compared to 20 large M&A events. In comparison, our analysis from two years ago showed acquisitions outnumbering IPOs by a ratio of nearly 10 to 1. The average market cap for all fintechs grew to $7.3B, up from $5.1B. Meanwhile, large M&A pricing increased in value to $1.1B in 2025, up from just over $400m.

In all, fintech was one of the most liquid sectors in tech. These exit events also represented a significant maturation of the industry. We saw both new acquirers and a new cohort of scaled companies emerge that set the conditions for this stepchange in exits. Perhaps most optimistically, the AI opportunity hasn’t really begun to show in this data. As we see more startups being created in AI financial services, and more transformative initiatives within public companies, we expect these numbers to continue to grow.

The Updated Exit Landscape for Fintech

In 2025, fintech IPO and M&A activity dramatically ramped up for VC-backed fintech companies, producing all time highs for both. As with our last report, we created a representative index to show performance and trends for these VC-backed companies.

IPOs: a Banner Year

With 22 IPOs, fintech represented 39% of all tech IPOs in 2025 and 21% of total IPOs. This despite receiving just 12% of VC funding over the past 10 years. The average market cap across the whole cohort increased to $7.3B.

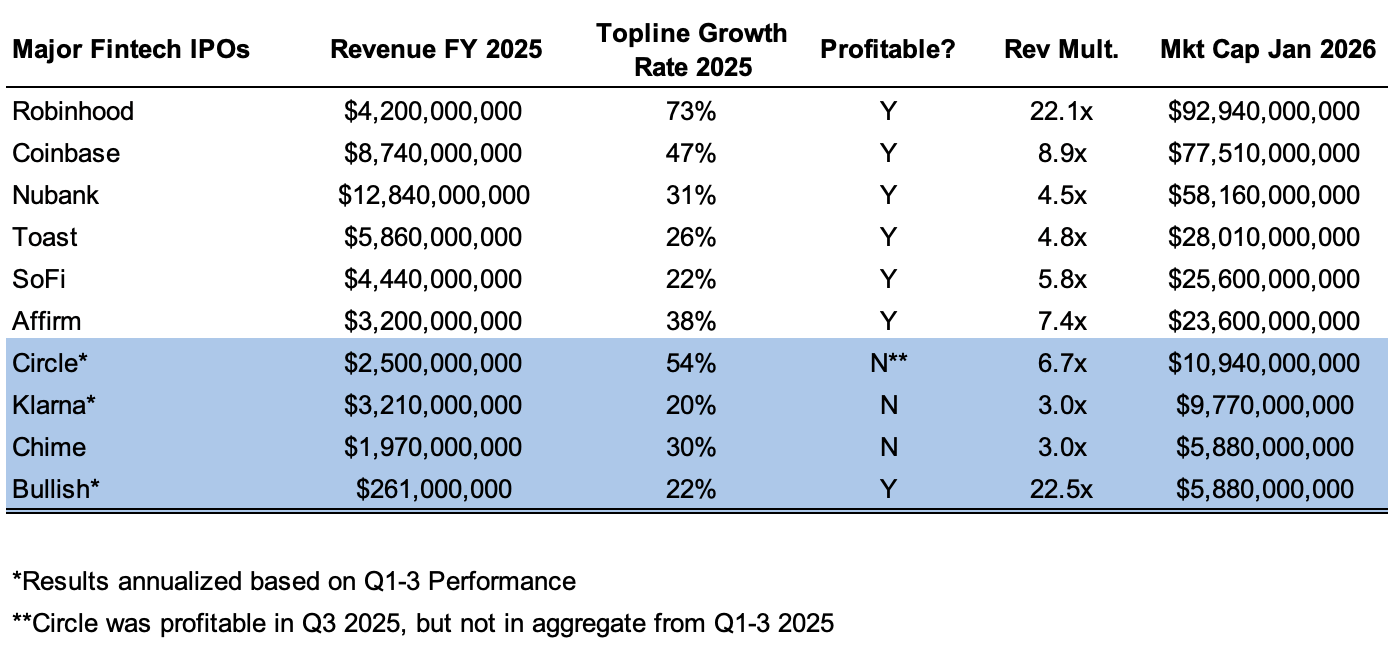

In 2025, over 20 fintech companies IPO’d, and the average market cap of those companies is $4.1B, the second highest valuations on record after the 2021 cohort. Circle, which priced its shares at $31, began public trading at $69 per share and reached a high of nearly $299 just a few weeks after listing. Circle now sits above $72 per share. Chime listed at $27 and saw a 37% increase on the first day of trading. Four companies from the 2025 cohort (Circle, Chime, Klarna, and Bullish) are in the top ten of our index in terms of enterprise value.

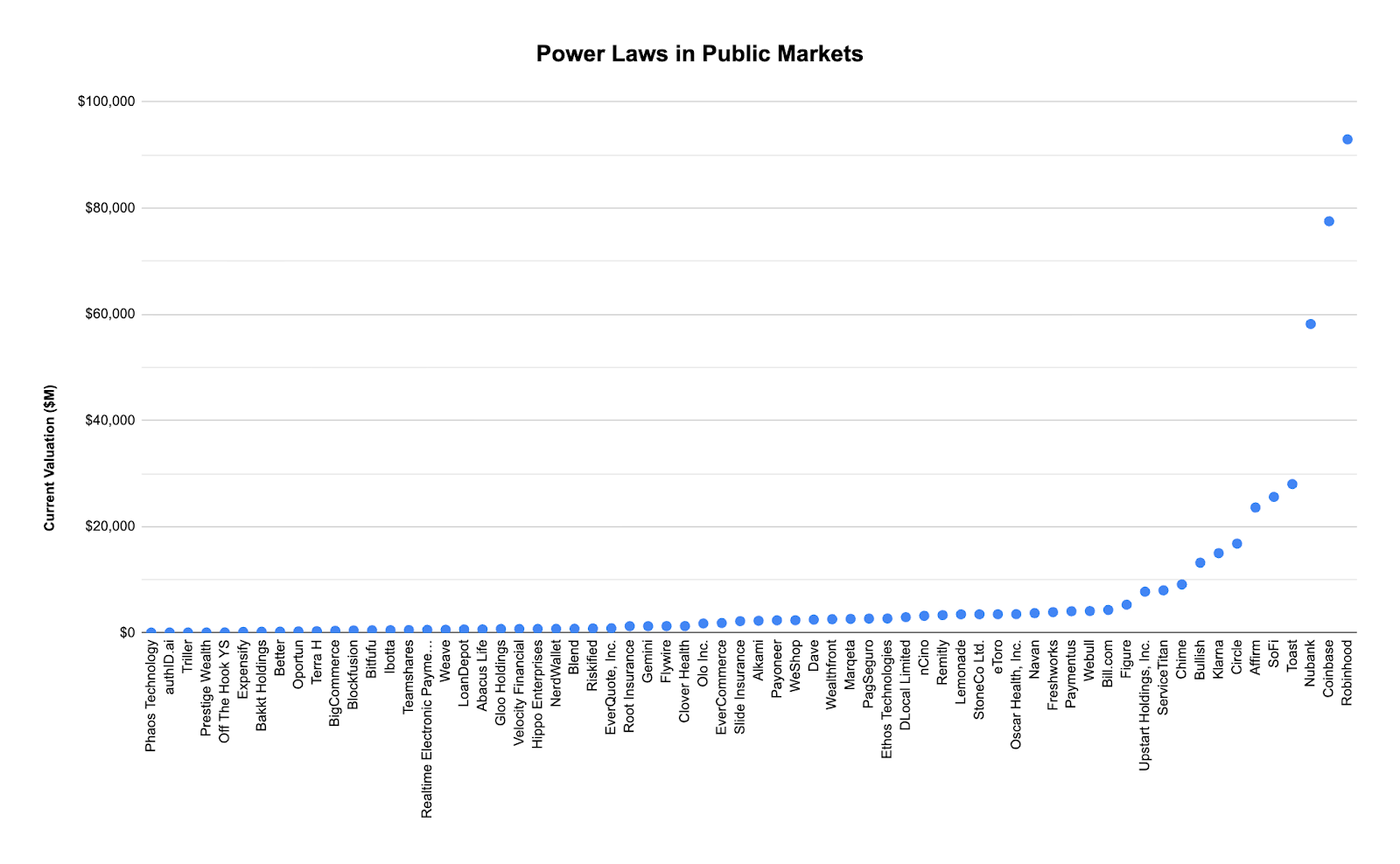

Just like the “Mag 7” dominate public markets today, fintech is defined by a similar cohort of “Racehorses”: Coinbase, Nubank, and Robinhood represent just over 40% of aggregate enterprise value, while Toast, SoFi, and Affirm round out the companies with market caps above $20B. What distinguishes these Racehorses is not simply size, but a combination of durable revenue models, distribution advantages, and the ability to compound growth. Of the top six fintech IPOs, their average 2025 revenue was over $6.5B, growing at an average rate of 40%, and all profitable. Compare this with the remainder of the cohort, which averages $1.1 billion in annual revenue and 27% year-over-year growth. Stronger business fundamentals are also reflected in valuation multiples. The median revenue multiple for these companies is 7.4x sales, compared with 2.6x for the remainder of the cohort. In short, we very much see the power law in effect.

The flip side is that the vast majority of public companies are subscale at best, and at worst have simply underperformed. Many IPOs were defined by an exhaustion of private funds or clauses in private round termsheets that encouraged companies going public. For all companies outside of the Top 6, the average 2025 revenue was $1.08B, and many had revenues much lower than that. The median delta between the IPO price and the current market cap for companies outside of the top 6 is -41%. We’ve seen that the public markets have functioned less as a funding mechanism and more as a sorting mechanism, where IPOs have rapidly separated strong businesses from those that were early, subscale, or structurally weaker. In sum: the IPO is not the finish line. There is a ruthless market that rewards top performers and brutally punishes those with low growth and underperforming business models.

One of the outstanding questions from the last two years is whether the Racehorses of 2025 (Circle, Klarna, and Chime) will be able to retain their position. The table below outlines the Top 10 public fintech companies by market cap, with the 2025 exits highlighted in blue.

These four companies are a microcosm of fintech more broadly, with drastically different business models, growth stories, scale and multiples. If they are able to sustain or increase growth, they have the potential to remain frontrunners. Otherwise they are likely to face the harsh realities of the public market.

M&A: A Stepchange in Valuation

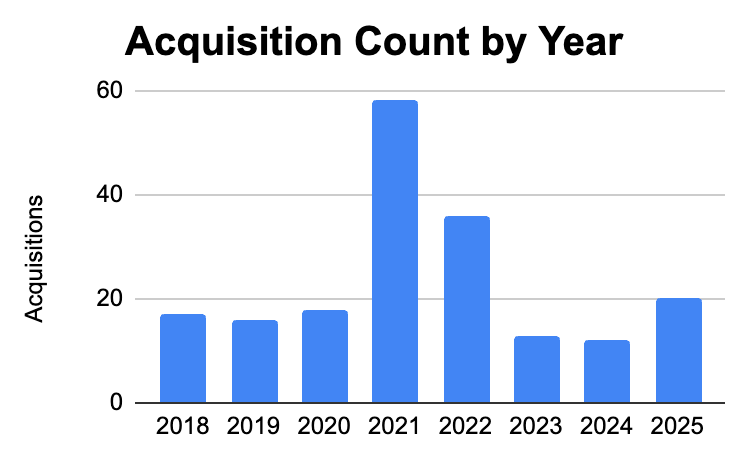

M&A growth over the past two years surpassed 2020, which many considered to be the high water mark in fintech. Deal volume returned to historical levels, while average deal size dramatically increased.

The 2025 valuations represented a 2.8x increase from our prior analysis of average M&A price. Across all years, the average large M&A deal increased to $532M.

2024 and 2025 tell different stories about the increase in valuations. In 2024, the largest acquisitions were driven by private equity, such as Vista’s $4B acquisition of EngageSmart and HG Capital’s $3B acquisition of AuditBoard. It was a year marked by fewer transactions at high prices, with corporate acquirers for the most part sitting on the sidelines. Our conversations with corporate and strategic acquirers at that time indicated interest in M&A. However, because private market valuations in 2020 and 2021 were so far ahead of actual enterprise value, most strategic acquirers could not land on a price that was reasonable, and founders and VCs may not have wanted to take a hit to their sky-high valuations. Showing the diversity of fintech acquirers, this opened the door for well-capitalized PE firms to step in and actively acquire.

This sentiment changed in 2025. That year, a major driver was large fintech companies aggressively entering the acquisition arena. This includes Coinbase’s $2.9B acquisition of Deribit, Xero’s $2.5B acquisition of Melio, Ripple’s $1.25B acquisition of Hidden Road, and Door Dash’s $1.2B acquisition of SevenRooms. Traditional acquirers, such as MasterCard, Munich Re, and Verisk, all completed acquisitions north of $2B as well. For many, these were catalytic acquisitions that were fueled by record stock performance and strong cash reserves. Both the Coinbase and Ripple acquisitions also took advantage of greater regulatory clarity within crypto and trading. For others, it appears that the “bid-ask spreads” between acquirers and startups finally converged.

2025 announced the entrance of a new class of companies to large-scale M&A. Perhaps the most straightforward way to analyze the differences between the 2024 and 2025 acquirers is by looking at their founding age. In 2024, there were five M&A transactions of greater than $1B, none of which was completed by a firm founded after 2010. In 2025, there were 11 M&A transactions north of $1B, of which five transactions were completed by firms started after 2010. As we see public and late-stage private fintechs grow and mature, they too will increase their participation within the M&A environment. We expect the “age” of large acquirers to only get younger in the coming years as new companies 1) increase the amount of capital they have for acquisition (through IPOs and compounded earnings) and 2) look to accelerate their product roadmaps through outside acquisitions instead of internal development. This will very visibly play out in AI.

Implications

Given these new dynamics, what should founders and investors consider as they look towards 2026 and beyond?

Aim to be a fintech “Racehorse”. The vast majority of enterprise value has accrued to just a few names, and they are rewarded with strong multiples, name brand recognition, and category-defining outcomes. For them, things like a $7B average market cap have little bearing on their reality. Business model plays a major factor here, where SaaS, marketplace, and infrastructure companies continue to be rewarded, something that has trickle-down effects to the earliest stages of investment. Many of the companies that went public in 2025 have the potential to remain Racehorses, assuming they focus on fundamentals and, most importantly, growth. For everyone else, they are likely to be relegated to the group of low-growth, low-multiple companies.

Scaled fintechs will drive more exits in 2026. The supply of quality fintechs is still very high: Stripe, Ramp, Airwallex, Flex, and a whole slew of other companies that have been built in recent years are maturing to a point where they can realize large public exits. An entirely separate class of companies has been built and matured that are ripe for acquisition. To advance this point, just before publication, Brex exited to Capital One for $5.15B, underscoring the willingness of incumbents to deploy capital for strong, strategic assets.

A step change for M&A prices? The last two years were outliers in terms of M&A prices, but we have reason to believe M&A values are showing a true reset. Seeing more large tech companies enter the acquisition fray and PE funds aggressively move into fintech introduces buyers that have not been as active in prior years. Coupled with what we think will be a strong year for M&A (see next point below), we expect these dynamics to lead to elevated acquisition prices going forward.

Acquirers take an aggressive stance towards M&A. We believe that 2026 will be a strong year for M&A, and a series of point-in-time events are creating a bias towards action. First, none of the 2025 acquisitions account for AI growth—which we’d expect large companies to strategically position for via acquisition (including many that have recently IPOed). Second, we can assume that companies will take advantage of the permissive regulatory regime right now. Third, large companies have substantial access to capital based on public market runups. Finally, heading into 2026 there is an assertive posture by a subset of acquirers that is likely to influence the conversations and decisions within boardrooms across the market.

Fintech continues to be an incredibly dynamic market for investors and builders. As early stage investors, we’re especially bullish on founders and investors at the earliest stage of company formation, where there is ample room to realize strong returns in both public and private exits. As in previous years, fintech’s strong M&A ecosystem benefits from a diversity of acquirers and creates opportunities for founders and investors to realize liquidity at earlier stages than standard IPO timelines. We expect the dynamics in today's market to turbocharge these outcomes.

Annex: companies included in this analysis

All private data and company lists sourced from Pitchbook

Public market caps sourced from Finviz in December 2025 / January 2026

Abacus Life (NAS: ABL)

Affirm (NAS: AFRM)

Alkami (NAS: ALKT)

authID.ai (NAS: AUID)

Bakkt Holdings (NYSE: BKKT)

Better (NAS: BETR)

BigCommerce (NAS: BIGC)

Bill.com (NYS: BILL)

Blend (Financial Software) (NYS: BLND)

Chime (NAS: CHYM)

Circle (NYSE: CRCL)

Clover Health Investments, Corp. (CLOV)

Coinbase (NAS: COIN)

CONX Corp (NAS: CONX)

Dave (NAS: DAVE)

DLocal Limited (NAS: DLO)

EngageSmart (NYS: ESMT)

eToro (NAS: ETOR)

EverCommerce (NAS: EVCM)

EverQuote, Inc. (NAS: EVER)

Expensify (NAS: EXFY)

Figure (NAS: FIGR)

Flywire (NAS: FLYW)

Freshworks (NAS: FRSH)

Gemini (NAS: GEMI)

Hippo Enterprises (NYS: HIPO)

Klarna (NYSE: KLAR

Lemonade (NYSE: LMND)

LoanDepot (NYSE: LDI)

Marqeta (NAS: MQ)

MoneyLion (NYSE: ML)

nCino (NAS: NCNO)

NerdWallet (NAS: NRDS)

Nubank (NYSE: NU)

Olo Inc. (OLO)

Oportun (NAS: OPRT)

Oscar Health, Inc. (OSCR)

PagSeguro (NYSE: PAGS)

Paymentus (NYSE: PAY)

Payoneer (NAS: PAYO)

Realtime Electronic Payments (NAS: RPAY)

Remitly (NAS: RELY)

Riskified (NYSE: RSKD)

Robinhood (Brokerage) (NAS: HOOD)

Root Insurance (NAS: ROOT)

Service Titan (NAS: TTAN)

SoFi (Consumer Finance) (NAS: SOFI)

StoneCo Ltd. (NAS: STNE)

Toast (NYSE: TOST)

Upstart Holdings, Inc. (NAS: UPST)

Velocity Financial (NYSE: VEL)

Weave (NYSE: WEAV)

M&A:

Accrualify

Accu-Trade

Acima Credit

American First Finance

Appetize

Assurance IQ

Bay Equity

Beanworks

Berbix

Bison Trails

Blockfolio

Blue Marble Payroll

Bread

Bridg (Business/Productivity Software)

Bridge2 Solutions

Buildium

BuyerQuest

CARWAVE

Chargeback

CICO Digital Solutions

Clarity Insights

Clarity Money

ClickPay

ClickSWITCH

Cloud Lending Solutions

CloudCraze

Cobalt Software

Community Tax

CoreVest Finance

CoverWallet

Credible Insurance

Credit Karma

CreditIQ

Credly

Curv

D3 Banking

DAVO Technologies

Digit

Divvy

Earnifi

Ecwid

EQT Exeter

ErisX

EVEN Financial

Fair Square Financial

FairX

Finxact

Flexible Architecture and Simplified Technology

Floify

FolioDynamix

FourQ

Gabi

GammaRey

GradFin

Greenbacker Group

Hipercept

Honey Science

Hubdoc

HubTran

Inflection Risk Solutions

Inlet (New York)

InstaMed (Financial Software)

interLINK

JetPay

Kensho Technologies

Klarna

Kount

LevelCredit

Levelset

LevelUp

LibertyX

LifeWorks (Acquired)

Limelight Health

LiquidityEdge

Magento Commerce

Mazooma

Mercatus

Metrio

Metromile

Miami International Holdings

MineralTree

Mobeewave

mPower Trading Systems

Nearside

NetCHB

Nexosis

North Avenue Capital

Novus (Financial Software)

Nvoicepay

ObserveIT

On the Barrelhead

Ondot

OnFido

Palm NFT Studio

Pango USA

Paya

PayBright

Payix

Payment Alliance International

Payrailz

Payrix Solutions

Paystone

PayVeris

Payzer

Personal Capital, an Empower Company

Pineapple Payments

Pocket Your Dollars

Power

Poynt

PrecisionLender

Profitero

ProfitWell

Pronto Money Transfer

PropStream

Pry Financials

Punchh

QuadPay

QuoteWizard

Quovo

Rapid Financial Solutions

Redline Trading Solutions

RetailMeNot

Returnly

SafetyPay

Sagent Lending Technologies

Salty Dot

Say

Scalefast

Sendwave

Sentieo

Service Finance Company

SharesPost

ShopKeep

Simility

Simplee

SimpleNexus

Slide Insurance

StreetShares

Student Loan Hero

Syntellis Performance Solutions

Tapjoy

The Giving Block

The Penny Hoarder

Tipser

Title365

Tora Trading

Transport Financial Solutions

TriSource Solutions

Truebill

UpLift

ValuePenguin

Velocicast

VendEngine

Venmo

Verikai

ViaBill

Viewgol

Visible Equity

Vocado

Voyant

X1 Card

YouCaring

Zimit

Zuora

© 2025 Restive®, Inc.